Flat tax

A flat tax is used when the same tax rate is applied to every taxpayer irrespective of income level. It is not necessarily a fully proportional.

How Does A Progressive Income Tax System Work

A flat tax system applies the same tax rate to every taxpayer regardless of income bracket.

. Why notThe tax is a scam based on a lie. And then the Courts that failsafe of the political and corporate. House Bill 1 would move Idaho to a flat income tax structure reduce the rate from 6 to 58 percent exclude an additional 2500 single filers or 5000 joint filers from taxation.

In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses. A flat tax short for flat-rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base. A pure flat tax applies the same tax rate to all types of income.

Some states add a. La Flat Tax aussi appelée Prélèvement. For example a tax rate of 10 would mean that an individual.

Flat tax systems are ones that require all taxpayers to pay the same tax rate regardless of their income. To pay your sewer bill on line click here. Properties reflecting a variation with tax assessed being 10 percent or more above the samplings median level will be pinpointed for.

It was passed on the promise of property tax relief. No cash may be dropped off at any time in a box located at the front door of Town Hall. Georgias income tax is now scheduled to convert to a flat rate of 549 percent eventually.

United States Tax Court Bar Member. Tax and sewer payments checks only. Therefore except for the exemptions the economic.

Mississippi will have a flat tax as of next year with a 4 percent rate by 2026. Flat taxes are typically a flat rate rather than a flat dollar amount. With enactment of the flat tax in 94 days on January 1 Arizona will have the lowest flat tax in the nation.

Typically a flat tax applies the same tax rate to all taxpayers with no deductions or exemptions allowed but some politicians have proposed flat tax systems that keep certain deductions in place. 877-696-2109 Law Firm Profile Contact us. Bien que son nom paraisse anglophone la Flat Tax est un impôt français mis en place en 2018 sous le gouvernement Macron.

Governor Ducey signed the historic tax package into law last year further. These candidates tax assessments are then matched. Flat taxes are when everyone pays the same amount regardless of income.

Most flat tax systems or.

Republican Presidential Candidates Rally Around Flat Tax The New York Times

A Flat Tax Is Wrong For Georgia Georgia Budget And Policy Institute

Open Letter We Are Against The Flat Tax Proposal

The Case For Flat Taxes The Economist

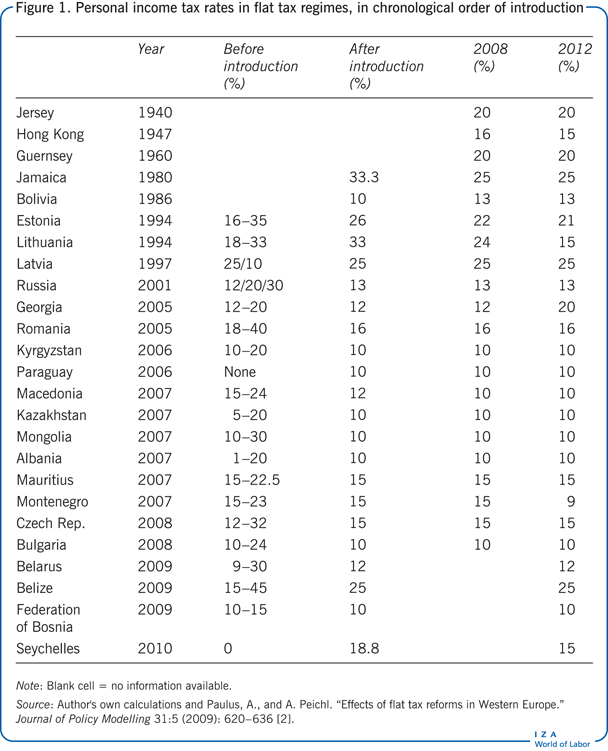

Current Flat Taxes Rates In Percent 1 Personal Income Tax Rates Download Table

Eliminate Poverty With Universal Basic Income And Flat Income Tax Bift

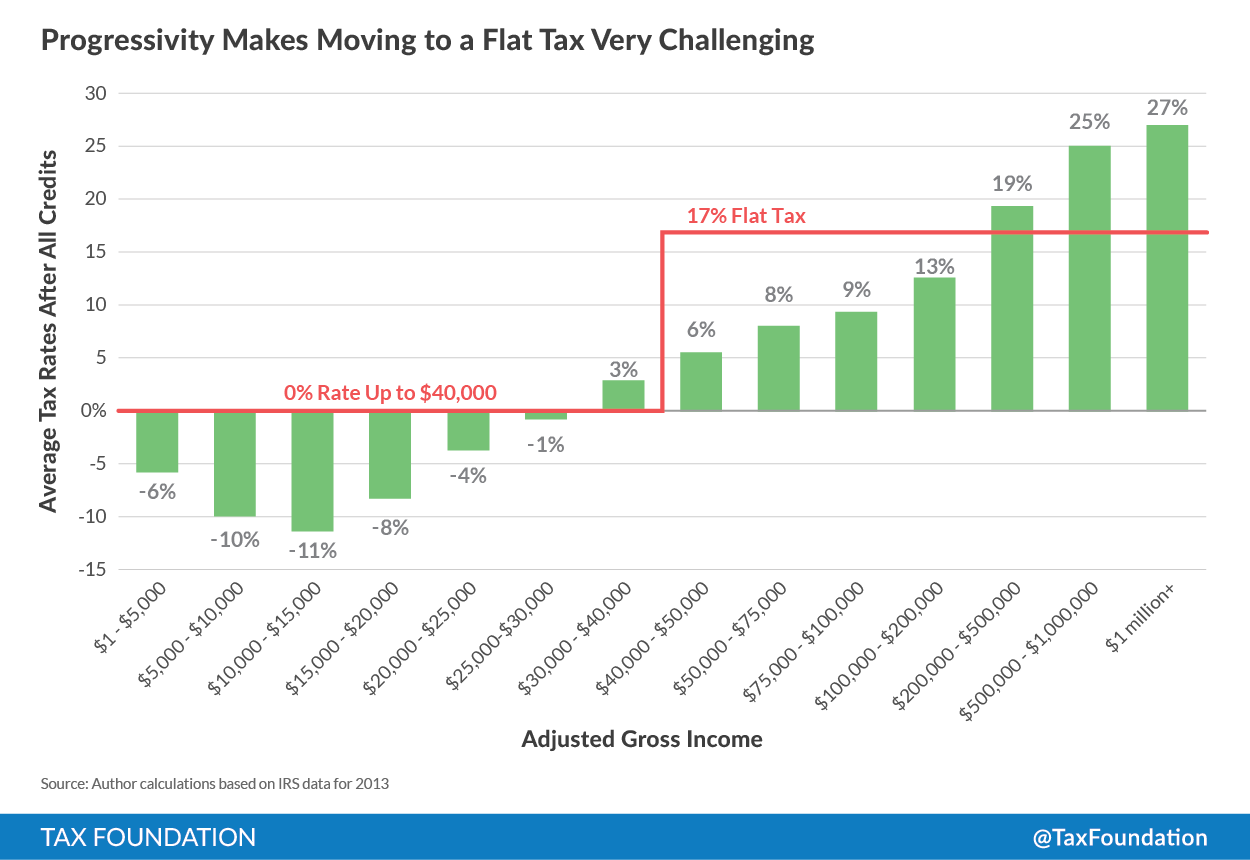

Biggest Challenge To Tax Reformers Overcoming Our Progressive Tax Code Tax Foundation

Illinois Used To Have One Competitive Advantage Over Its Neighbors Its Flat Tax Now That S Largely Gone Madison St Clair Record

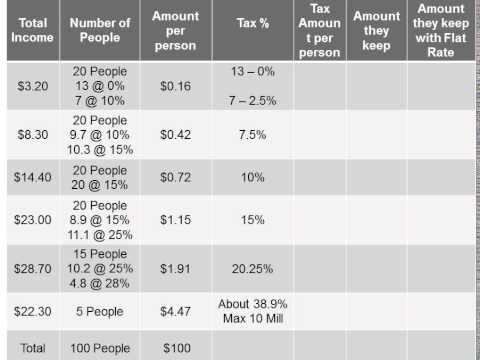

The Math Behind A Flat Tax Rate Youtube

Iowa Senate Republicans Release Flat Tax Proposal With Road To Elimination The Daily Iowan

Would A Flat Tax Be More Fair Youtube

Video Flat Tax Now I Get It Abc News

Assessing The Perry Flat Tax Tax Foundation

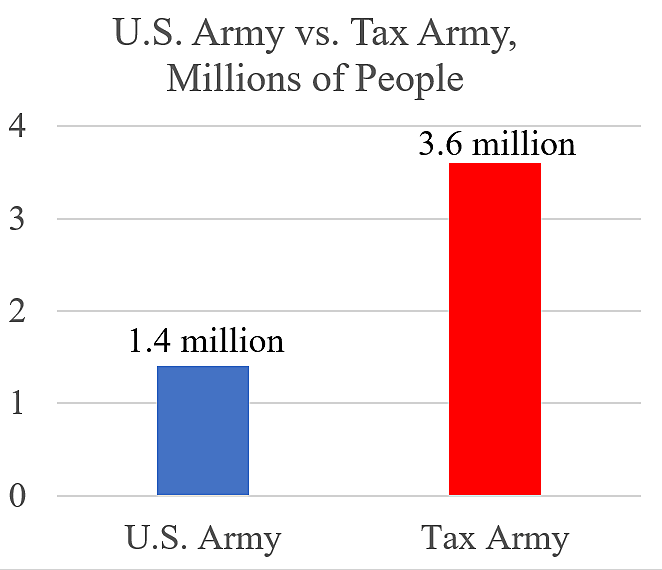

Irs Control Would Be Hampered By The Flat Tax The Daily Hatch

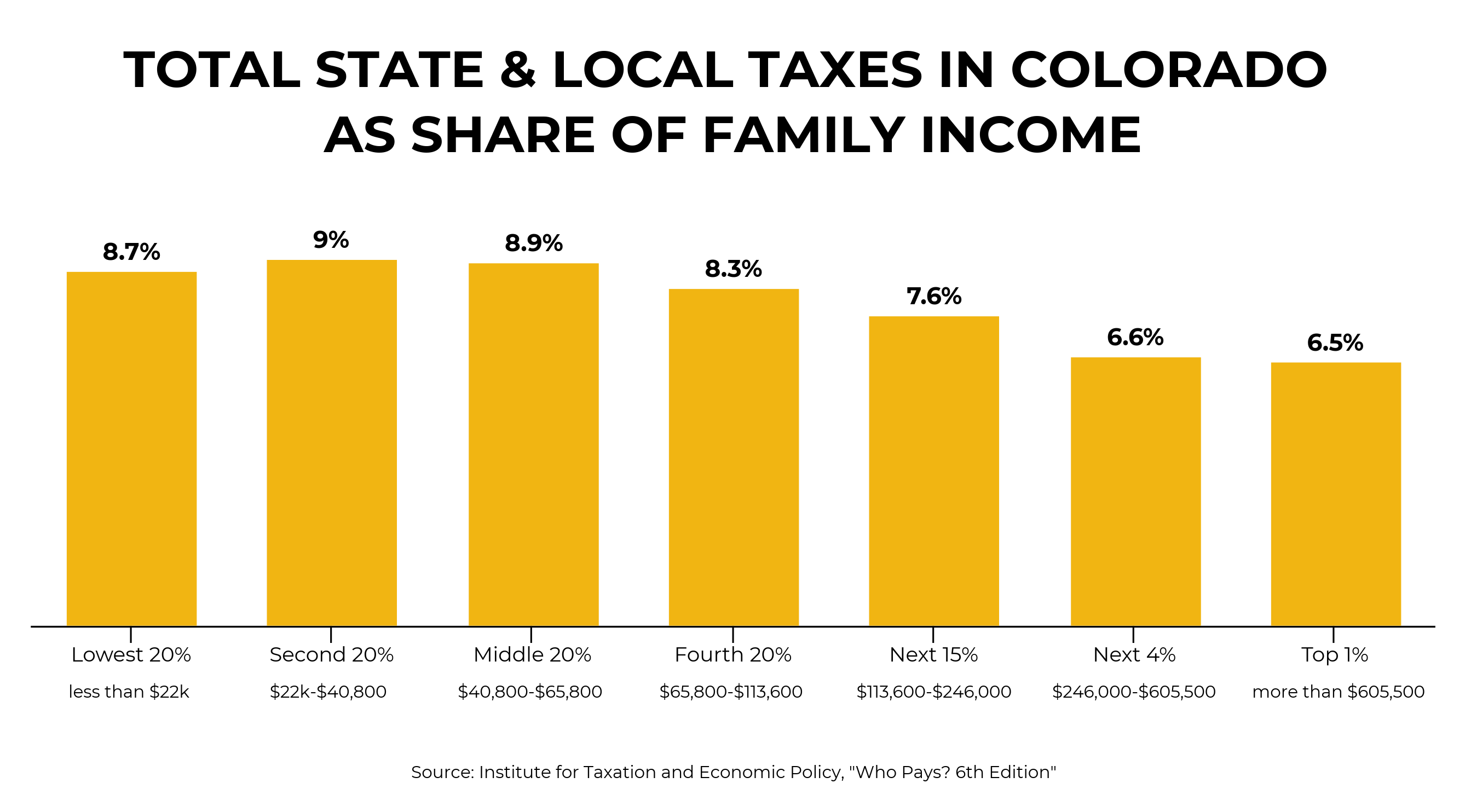

Study Shows Illinois Flat Tax System Is Harder On Black Latinx Taxpayers

Malcolm S Forbes Jr S 1 9 Billion Tax Cut For Himself Citizens For Tax Justice Working For A Fair And Sustainable Tax System

U S Tax Army To Expand Cato At Liberty Blog

Iza World Of Labor Flat Rate Tax Systems And Their Effect On Labor Markets