child tax credit october 2021

Parents of a child who ages out of an age bracket are paid the lesser amount. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

Latest Business News India Today 23 November 2021 News Headlines News India Today Latest Business News Business News

For each taxpayer receiving a payment the typical overpayment was 3125 per child between 6 and 17 years old and 3750 per child under 6 years old.

. To claim the full Child Tax Credit file a 2021 tax return. E-File Directly to the IRS. Import Your Tax Forms And Easily Maximize Your Deductions.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Even though child tax credit payments are scheduled to arrive on certain dates you may not. You can claim a maximum.

These changes will only apply for the 2021 tax year. If parents alternate years claiming their child on their tax return the IRS said it will send the 2021 advance child tax credit payments to the parent who claimed the child on their. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self. Likewise if a 17-year-old turns 18 in 2021 the parents are. October Child Tax Credit payment kept 36 million children from poverty Columbia University Center on Poverty and Social Policy According to our latest projections.

Time To Finish Up Your Taxes. This will result in. Eligibility Rules for Claiming the 2021 Child Tax Credit on a 2021 Tax Return These.

Learn More At AARP. For 2021 the child tax credit became more generous. The CTC has been revised in the following ways.

The 2021 advance monthly child tax credit payments started automatically in July. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6. Nearly all families with kids will qualify.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child. Frequently asked questions FAQs Margot L.

Tax Year 2021Filing Season 2022 Child Tax Credit Frequently Asked Questions Topic B. Children who attend college are qualifying children for. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for.

Title The expanded child tax credit for 2021. Thats an increase from the regular child tax. You can claim the full amount of the 2021 Child Tax Credit if youre eligible even if you dont normally file a tax return.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. The Child Tax Credit is a tax benefit to help families who are raising children.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Parents of eligible children under age 6 will receive 300 per child while those with children between ages 6 and 17 will receive 250 per child. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600.

Child tax credit 2021 october Tuesday August 30 2022 Edit. Ad Home of the Free Federal Tax Return. No Tax Knowledge Needed.

This historic support the largest ever credit is. This summer the Biden-Harris administrations American Rescue Plan Act increased the 2021 Child Tax Credit CTC. Ad Home of the Free Federal Tax Return.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Note Updated October 28 2021 Bibliography etc.

Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of 3600 per child. The American Rescue Plan has expanded the CTC for the 2021 tax year. Couples making less than 150000 and single parents also called Head.

E-File Directly to the IRS. To be a qualifying child for the 2021 tax year your dependent generally must. The American Rescue Plan Act expanded the child tax credit to include the following benefits.

The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. That means another payment is coming in about a week on Oct. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Home Buyer Income Tax Credit Is Fading Away Income Tax Tax Credits Income

This Is An Image 15008e11 Gif Worksheets Consumer Math Adjective Worksheet

2021 Child Tax Credit Advanced Payment Option Tas

Daily Banking Awareness 10 11 And 12 March 2021 Awareness Banking Financial

Latest India Business News Today 11 February 2021 News Headlines

Looking For A Better Way To Stay Cool And Save On Highenergyprices Video In 2022 Energy Saving Tips Irs Forms Financial Tax Accounting Software

Childctc The Child Tax Credit The White House

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

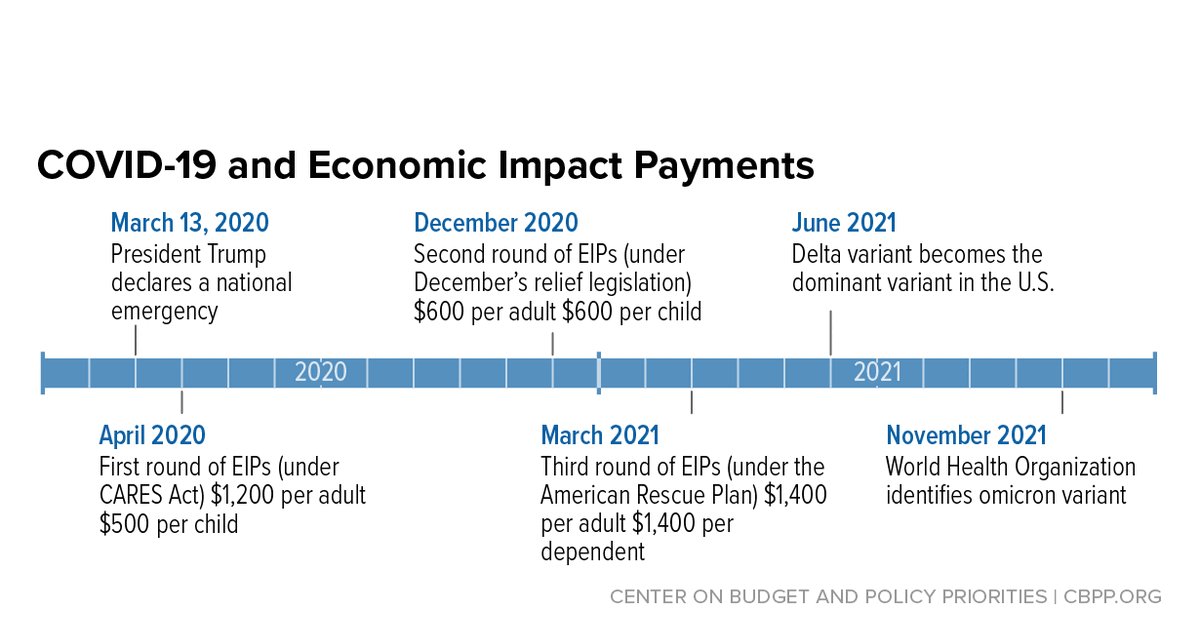

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

View Corporate Income Tax Done Next Should Be Gst Budgeting Tax Reduction Income Tax

What Does 11 Form Look Like What Does 11 Form Look Like Is So Famous But Why Tax Forms Irs Tax Forms Income Tax Return

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

Looking For A Better Way To Stay Cool And Save On Highenergyprices Video In 2022 Energy Saving Tips Irs Forms Financial Tax Accounting Software